All Categories

Featured

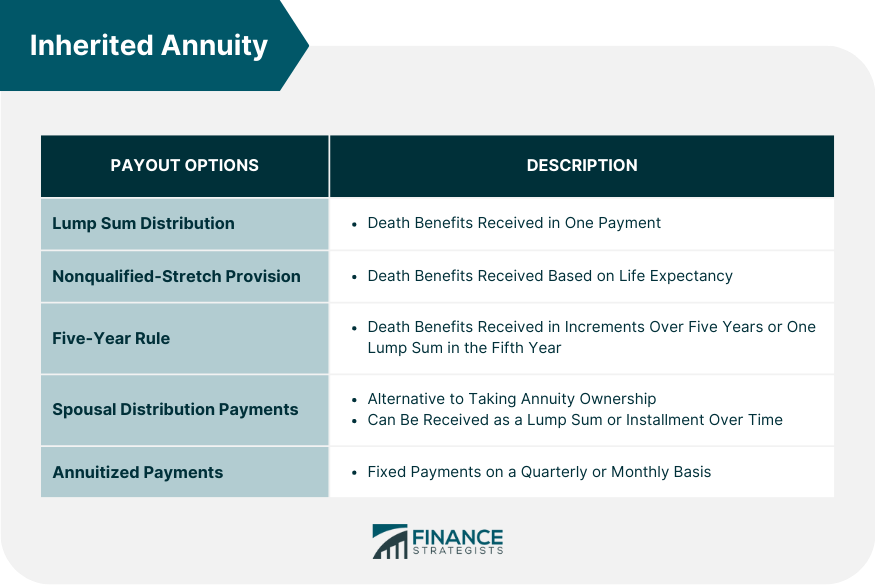

The finest choice for any type of individual need to be based on their present situations, tax scenario, and economic purposes. Annuity contracts. The cash from an inherited annuity can be paid as a solitary round figure, which becomes taxed in the year it is gotten - Retirement annuities. The drawback to this alternative is that the incomes in the contract are dispersed first, which are tired as normal revenue

If you don't have an instant demand for the cash from an inherited annuity, you could choose to roll it into an additional annuity you control. Through a 1035 exchange, you can guide the life insurer to move the cash money from your acquired annuity right into a brand-new annuity you establish. If the inherited annuity was originally established inside an IRA, you can trade it for a qualified annuity inside your own Individual retirement account.

Nonetheless, it is usually best to do so asap. This will certainly make certain that the payments are received immediately which any kind of concerns can be managed quickly. Annuity recipients can be disputed under specific situations, such as disagreements over the validity of the beneficiary designation or claims of unnecessary influence. Speak with lawful professionals for assistance

in disputed beneficiary scenarios (Annuity withdrawal options). An annuity death benefit pays out a collection quantity to your beneficiaries when you die. This is different from life insurance policy, which pays a death advantage based upon the face value of your plan. With an annuity, you are basically buying your own life, and the fatality benefit is meant to cover any type of exceptional costs or financial obligations you might have. Recipients receive settlements for the term defined in the annuity contract, which can be a set period or permanently. The timeframe for moneying in an annuity varies, but it often falls in between 1 and ten years, relying on contract terms and state legislations. If a beneficiary is incapacitated, a guardian or somebody with power of attorney will manage and receive the annuity payments on their part. Joint and beneficiary annuities are the two sorts of annuities that can avoid probate.

Latest Posts

Highlighting Variable Annuity Vs Fixed Indexed Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Interest Annuity Vs Variable Inve

Exploring the Basics of Retirement Options A Comprehensive Guide to Pros And Cons Of Fixed Annuity And Variable Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Fixed Inde

Analyzing Strategic Retirement Planning A Closer Look at What Is A Variable Annuity Vs A Fixed Annuity Breaking Down the Basics of Tax Benefits Of Fixed Vs Variable Annuities Benefits of Tax Benefits

More

Latest Posts